VCs kill their porfolio companies

It is not out of choice or malicious intent, but through ignorance. This is something we are trying to address by writing IMPACT and getting VCs to read it. VCs are a powerful voice on the boards of your start-up. Partly because of their shareholding, but also because they “have seen it and done it”. Except they haven’t. In many cases they have “seen it, not done it”. They don’t have the time to really understand the nitty gritty of what is happening inside a company. They have to take a fairly hands off, 50k feet view and be driven by the management reports. But that doesn’t stop them having a view, which can be forceful when the company is struggling.

Why VCs step in and force management’s hand

When you don’t hit the numbers on your business plan, it starts to get ugly. Narrowly missing your quarterly sales target, but with big deals forecast for the end of the year does not seem to be a red flag. However, come the end of the year and none of the big deals have closed and suddenly it is panic stations. But the biggest issue is “It is proving impossible to forecast sales closure on deals.” That spooks VCs.

But there are other vital signs for an innovative tech company that there are underlying problems:

- The solution should be selling in far greater volumes. Sales really isn’t scaling as expected.

- Every business buyer you approach loves the solution but is unable to find any serious budget.

- You are making sales, but they are only pilots, and the larger follow-on deals are stalling and delayed. And often you have multiple pilots in a single client.

- The cost of sales is too high to be sustainable long term: the business model does not work.

- You have hired a big-hitter sales guy with a proven track record from an established big tech company, but they are not delivering.

- The analysts firms such as Gartner or Forrester don’t seem get it and there is no Magic Quadrant or Wave that you naturally fit into.

- You are struggling to recruit partners who are able to resell the solution without huge levels of support from you.

- You have high levels of professional services vs. license sales.

- The customer’s IT and procurement teams are getting involved and are now proving to be a major roadblock.

The VC answer (which is wrong)

“Go and get a hard hitting Oracle sales guy”. The reason this is totally wrong is hidden in the IMPACT buying process. You need to read the book summary to understand the IMPACT cycle that the buyer goes through. But in summary:

The six key phases of the process are easy to remember as they have an enormous IMPACT on your company’s performance:

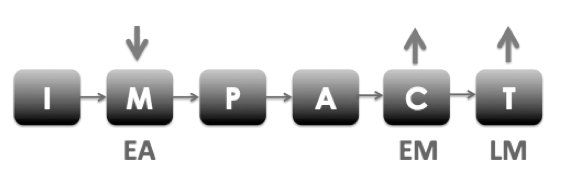

Idea – Mentor – Position – Assessment – Case – Transaction

Every purchase goes through all six phases, with or without the vendor (your) assistance. The reason that you probably don’t recognize this process is because the customer goes through the process on their own, and only invites you in at a certain point. What is critically important is the point at which you are invited in, as it affects how you engage with the buyer. And that in turn determines the operational culture of your company – i.e. how you organize, run and measure.

There are the Early Adopters (EA) who are happy buying innovative solutions. There are the Early Majority (EM) who want to buy the market leader. And there are the Late Majority (LM) who want to buy a commodity at the cheapest price. Here is where the buyer starts to engage in terms of the IMPACT process.

The Early Adopters are inspired when you or a consultant meets them and suggests an idea that reveals things to them that they did not already know. So the opportunity is generated by you when you connect with an evangelist in the customer at Mentor. That means you are working with the customer from Mentor through to Transaction. This is unlikely to be competitive, but highly consultative.

The Early Majority reach out to potential vendors when they have a set of requirements and a budget, so they have built their own business case – at Case. So you would work with the customer – procurement and IT – through Case and Transaction in a competitive procurement process.

The Late Majority only makes contact when they are ready to place an order – at Transaction. This will be from the procurement team at the customer and will be a “sharpen your pencil and give me your best price” gig.

The customer goes through the full cycle, with or without you. Once you are invited in, you are with them on the journey through to Transaction, no matter how long it takes and how much effort is required from you and the customer. The only alternative is that at some stage the idea is shelved or dropped.

The Oracle sales guy (or equivalent) is used to selling to the Early Majority who have a budget, set of requirements, RFP and a procurement cycle. They are confused, frustrated and cannot understand the buyer behaviour of the Early Adopter. They see buyers and commissions. They are oblivious to the IMPACT process as they pitch and close customers. They fail but drag the company down with them.

VCs are equally confused as they don’t know about the IMPACT buying cycle and want you to be selling to the Early majority, because that is where the big money is made. But because you are innovative and early stage. So your market is not mature enough for the Early Majority to purchase.

Coaching your VC

VCs need to understand the implications of the IMPACT cycle and your place within it. You cannot change it. You cannot magically sell to the Early Majority – nor do you want to – yet. You need to take your VC through the IMPACT cycle and explain where you are engaging customers. Give them the book summary. And get them to read it Or get me to talk to them. I am the “stranger with a briefcase” so will possibly have more credibility.

What should VCs do?

The concepts in IMPACT are equally important for investors as they are for CEOs. Before they invest in a company, does it have the correct business model and operational culture? A pretty fundamental question. But simply asking the management of the company you are about to invest in is probably not enough. They are hardly going to say that they didn’t have the correct business model. Clearly this is not the only due diligence. You still need to evaluate the management team, the solution, the market, and the competition. But now you have another lens or perspective that will make you ask some different questions throughout the due diligence:

- How attuned is the management team to the different buying cultures?

- Is the solution, or the target markets for the solution, likely to be Value Added or Value Created?

- Are the management and sales team hard-core Value Added or consultative Value Created?

- Is the competition aligned with their buying cultures, or is there an opportunity to sneak an advantage?

- If there is misalignment between the company’s operational culture and the market buying culture, can you influence it to dramatically scale the company?

A fairly simple, quick, and relatively unobtrusive approach would be to do the analysis of solution/proposition vs. buying culture. This will give you a clear view on their alignment and massively de-risk your investment.

They also have a portfolio of companies they have invested in. How many of the companies with great solutions are failing to meet expectations when you invested? Have they simply written them off as part of ‘portfolio investing’ – you get some stars and some dogs. Sometimes you cannot legislate which are going to be stars or dogs. So a good investor makes so much on the stars that the dogs don’t matter to the portfolio.

What if that were not 100 percent true? They don’t invest in dogs. They perform weeks of expensive due diligence to avoid the dogs. They hope to pick only stars – so what goes wrong? What if they could help the dogs become stars, just by applying the buying culture and IMPACT principles?